Country

Services

Country

Services

Collecteaze is an AI-powered risk recovery solution designed to streamline debt collection for banks and agencies. By automating processes and utilizing data-driven insights, Collecteaze enhances operational efficiency, reduces costs, and improves profitability for financial institutions.

Debt collection agencies and banks in India face several issues, including:

Decentralized operations lead to inefficiencies and inconsistent performance.

Outdated systems and manual handovers slow down recovery efforts.

Limited skilled labor and security vulnerabilities, especially with cash transactions, hinder effective collections.

Inefficiencies and lack of automation raise operational expenses, impacting profitability.

Collecteaze was developed to address these challenges, focusing on:

Streamlining workflows to eliminate unproductive tasks.

Predictive analytics to optimize collection efforts and improve cash flow.

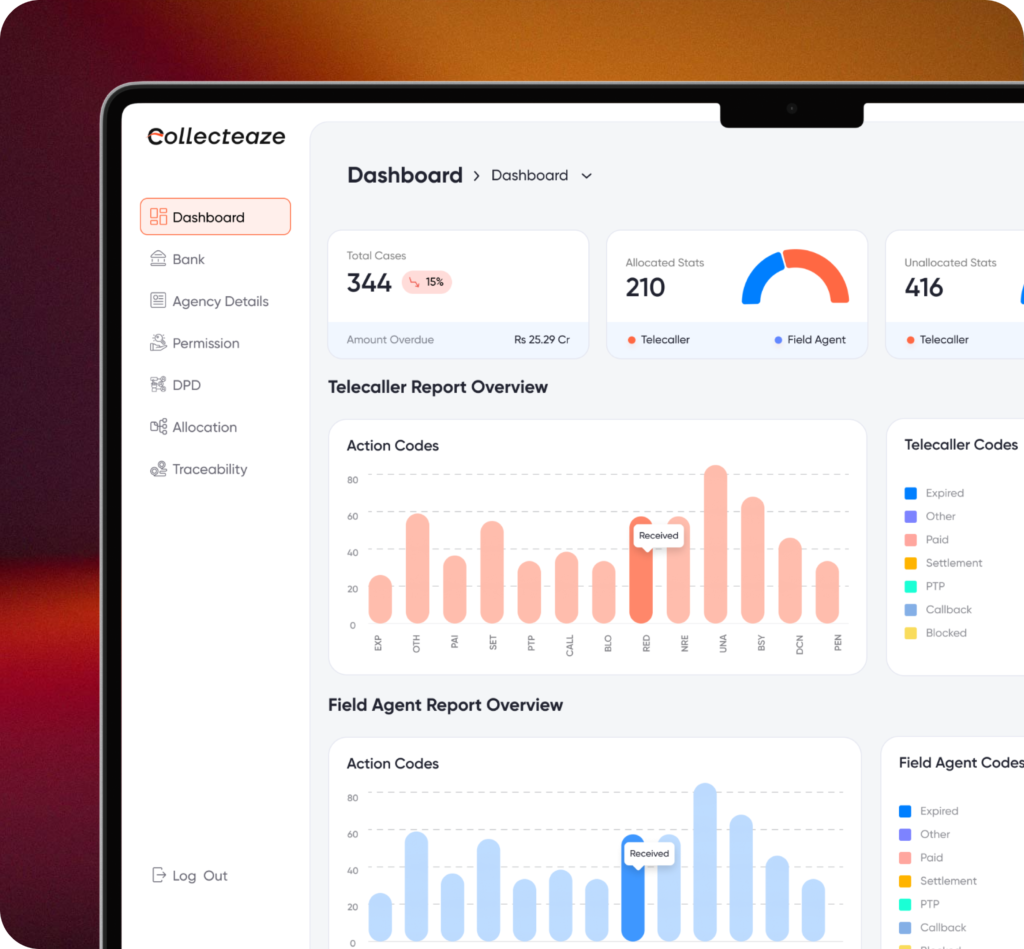

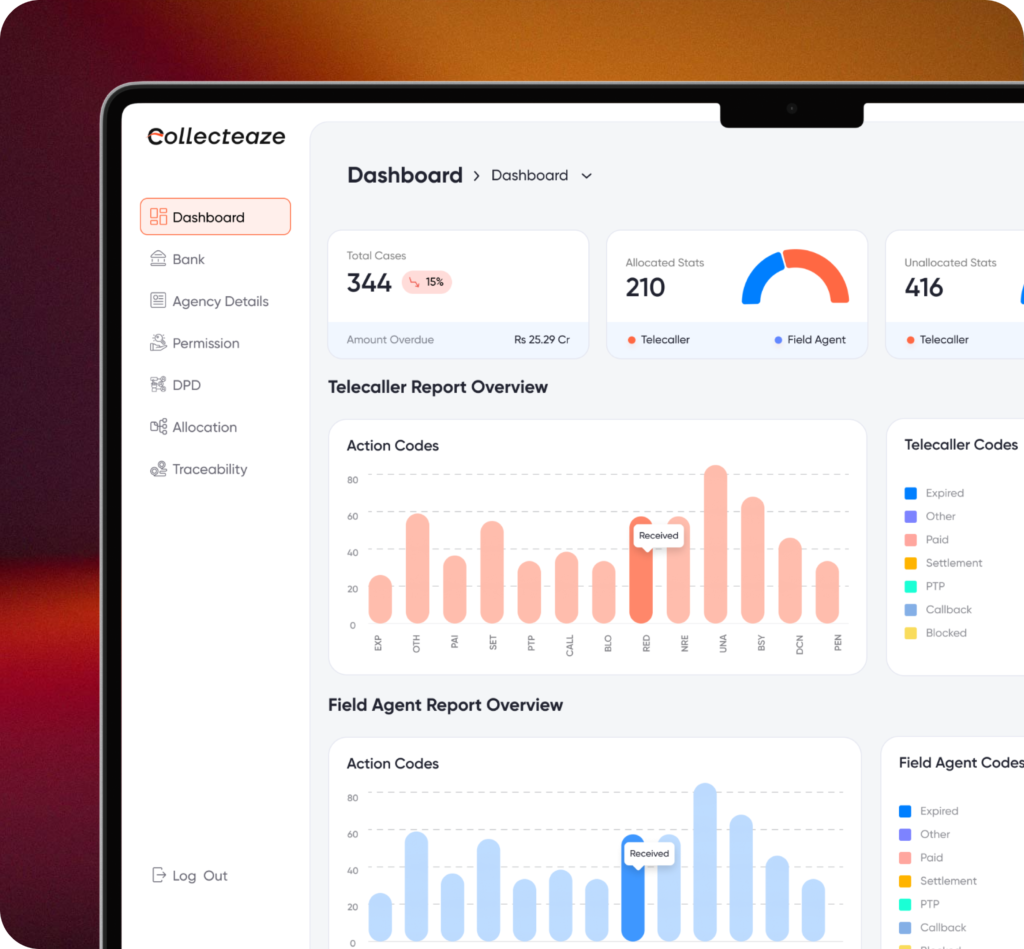

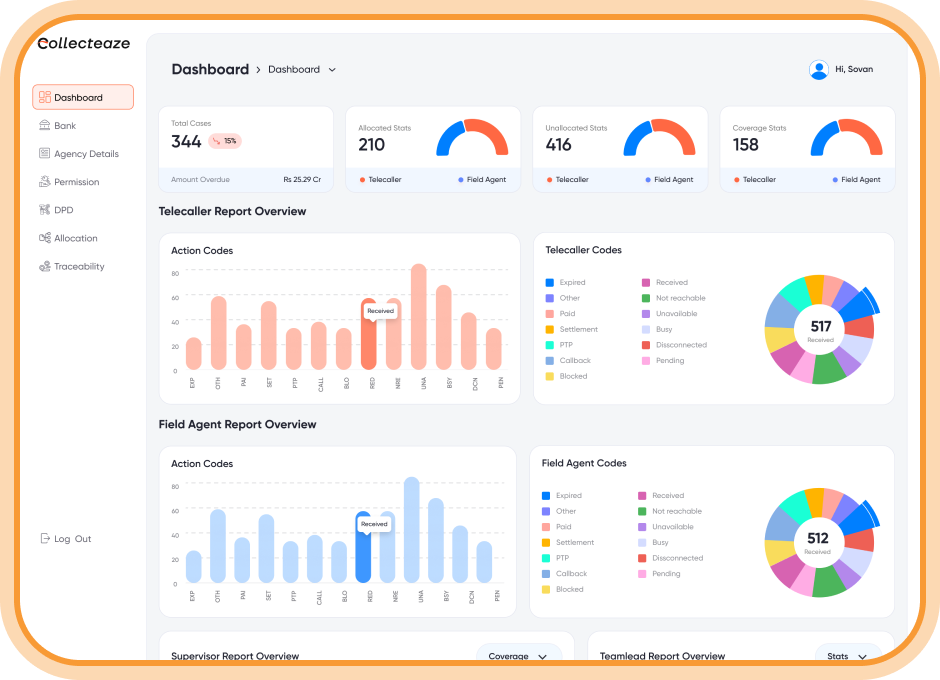

Dashboards that provide up-to-date insights for better decision-making.

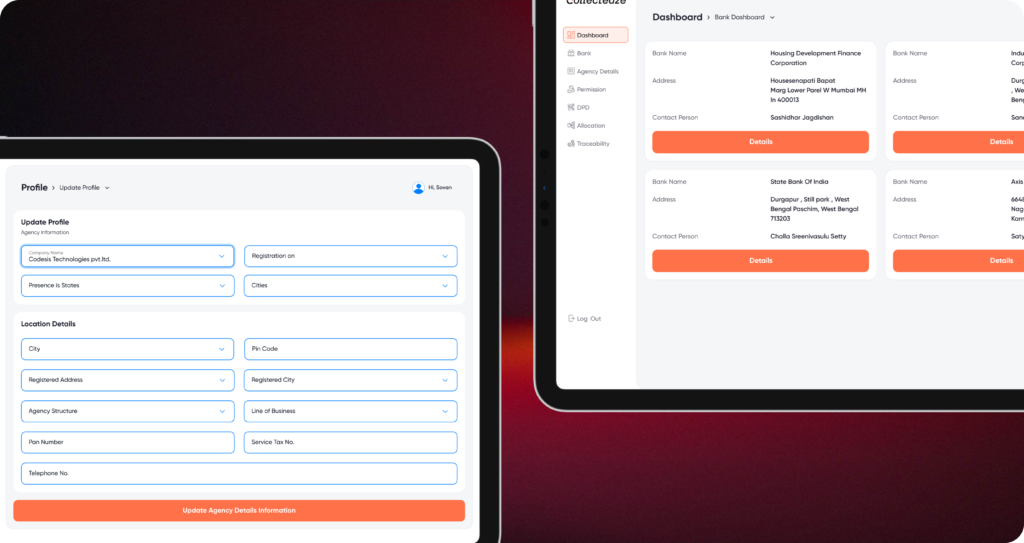

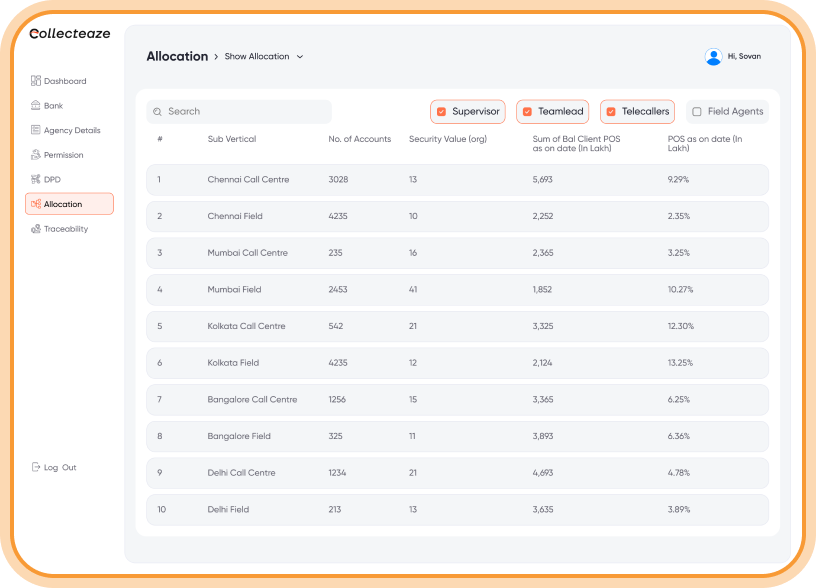

Collecteaze offers a comprehensive platform with key features

Automates repetitive tasks, reducing manual effort and errors.

Provides real-time insights into metrics like Days Sales Outstanding (DSO), aging debt, and borrower behavior.

Forecasts borrower payment behavior to prioritize high-value collections and improve recovery rates.

Protects sensitive data and enhances client communication through automated alerts and reminders.

Collecteaze has been successfully implemented across multiple firms, with over eight trading firms currently using the solution globally. The platform’s flexibility, integration capabilities, and scalability have allowed it to support growth and improve recovery operations for clients across industries.

AI-driven prioritization boosts recovery success.

Agencies leveraging Collecteaze’s tech-driven approach stand out in the competitive lending market.

The platform’s autoscalable infrastructure supports expansion without complex reconfiguration.

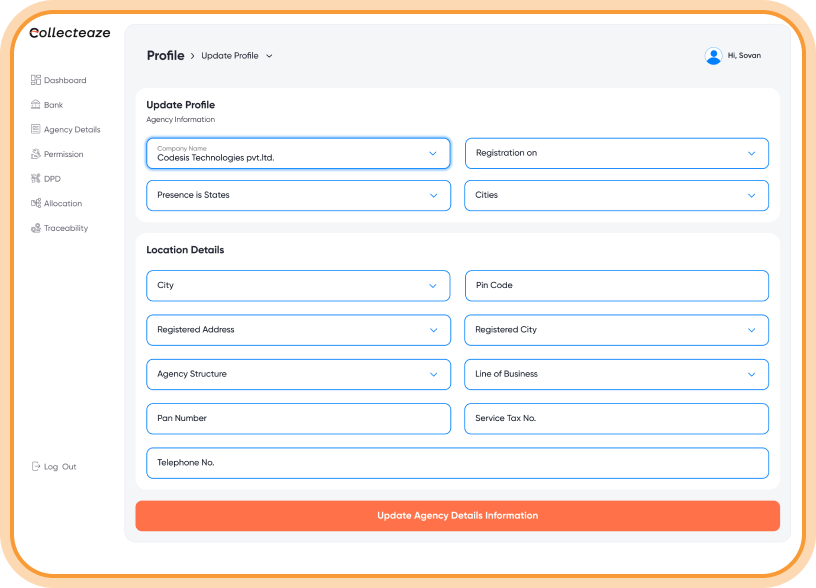

At Codesis Technologies, we build transformative digital solutions that drive performance and innovation. With a team of over 100 skilled professionals, we deliver impactful results for clients across 30+ countries.